With the new administration underway, many tax professionals have been discussing possible estate tax changes that may take place. While little has been decided yet, there are several changes expected. Did you know that these include alterations to the step-up basis at death in asset values, lowering of the federal estate and gift tax exemption limits, and possibly another type of wealth tax? While estate tax changes may be expected, it can be tough to say how big the changes will be. Let us review three areas where it may help to plan ahead for expected estate tax changes in 2021.

1. The Federal Estate and Gift Tax Exemption. Currently, the federal estate and gift tax exemption is so high that few people have much to worry about. If your estate is valued at $11.7 million or less for an individual or $23.4 million or less for a married couple, it will not be subject to federal estate tax. One of the expected estate tax changes, however, is a lowering of these minimum thresholds. One proposal in Congress has the exemption capped at $3.5 million for an individual or $7 million for a married couple, which slashes the current amounts by more than two-thirds. Even if we do not know the exact new thresholds, you might consider making some gifts or setting up an irrevocable trust, now, if you have an estate that is somewhere between one-half and the full current limits.

2. Transferring Wealth. If you are not sure about the new federal limits on the estate tax exemption, but you still want to be prepared for possible changes, it may be useful to set up an irrevocable trust now and fund it minimally. If more concrete changes appear on the horizon, you may be able to transfer more of your wealth into the trust at that time, without having to worry about doing the initial work to set it up.

3. The Step-Up Basis in Asset Valuation. Currently, when you pass away, any assets transferred to your heirs have their basis stepped up to the current valuation, so your heirs do not pay capital gains tax on any increase in value since you first acquired the assets. Proposals in Congress could eliminate this step-up basis and require your heirs to either pay capital gains tax when they inherit, or when they sell an asset. Consider not being too hasty in trying to sell assets now assuming a higher tax rate is coming. This may be one area where taking your time to see which changes are implemented may be useful.

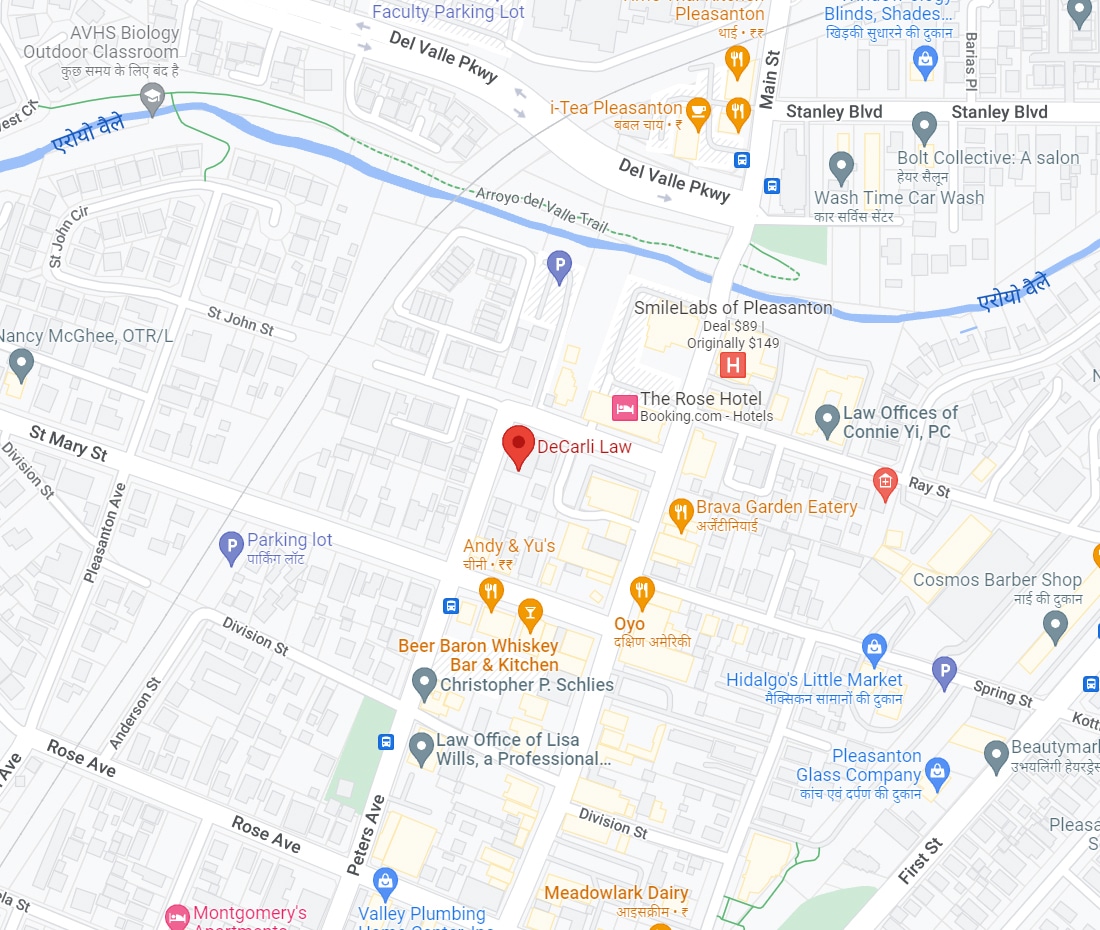

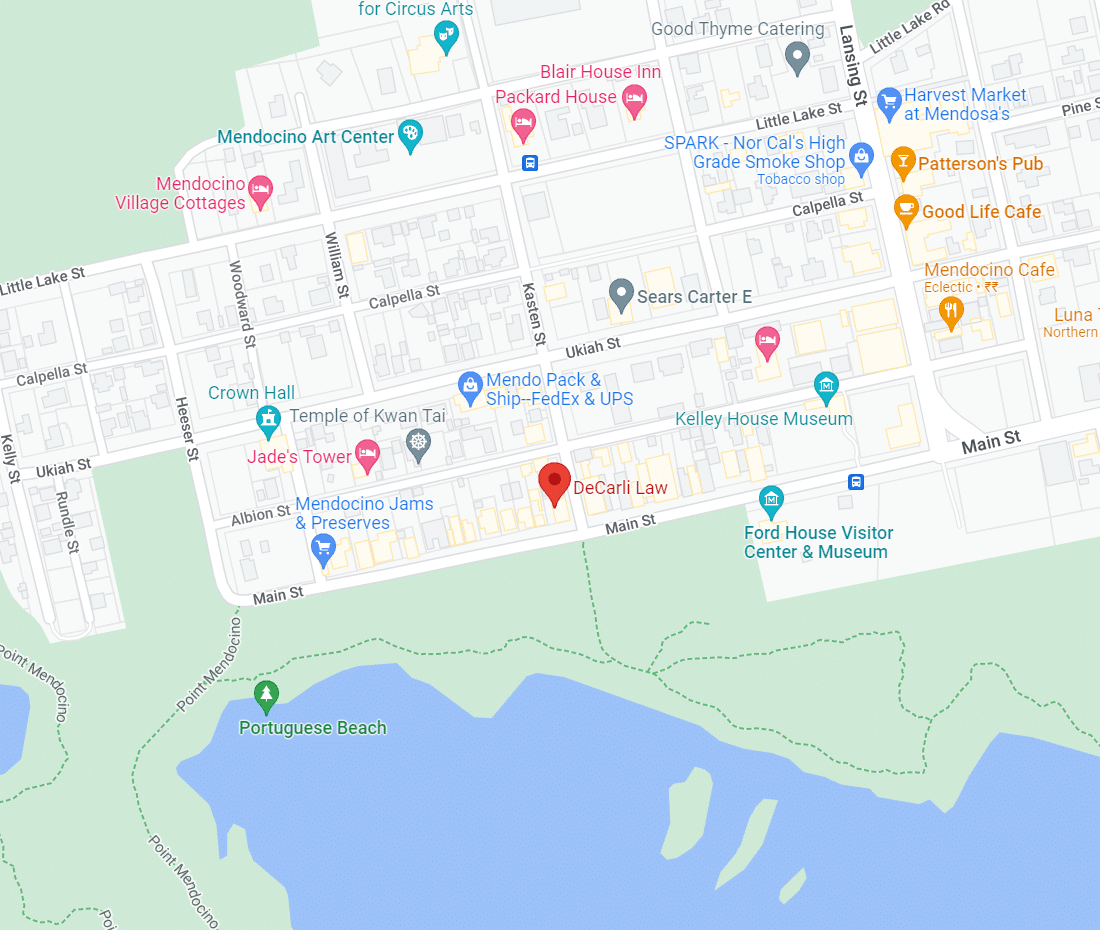

For assistance navigating the potential estate tax changes on the horizon, please reach out to our office to schedule an appointment.