When you create a living trust, you usually need to choose who to name as your successor trustee. It is crucial that this decision is not taken lightly and that the right person is selected for the job.

What or Who is a Successor Trustee

If you become incapacitated, your successor trustee will step into your shoes and take full control of your trust assets on your behalf. This means he or she will have full authority to make financial decisions—including selling or refinancing trust assets. In fact, as long as the act does not interfere with the instructions in the trust document and does not breach any fiduciary duty owed, your successor trustee is given broad authority over your trust assets. The authority is very helpful in many circumstances because it avoids costly, time consuming court proceedings, like guardianship, conservatorship, or probate.

After your death, your successor trustee acts in the same capacity as an executor: taking an inventory of all trust assets, paying outstanding debts, selling assets (if needed), preparing your final tax return, and distributing any remaining trust assets according to the instructions in your trust document.

Under either scenario, your successor trustee will perform his or her acts without court supervision, providing your family with privacy and usually reducing costs. While a living trust allows for your affairs to be handled efficiently and privately, it is up to your successor trust to ensure the administration begins and stays on track. That being said, the successor trustee need not be an expert on what to do and when. Your estate planning attorney, CPA, and other financial advisors can be enlisted to help guide him or her through this process.

Choosing a Successor Trustee

A successor trustee can be a spouse, adult child, other relative, trusted friend, or a corporate trustee. If you chose a non-corporate trustee, it is important to name a sequence of people in case your first choice is unable to act as trustee. Whomever you choose, it should be someone you know and trust, whose judgment you respect, and who will respect your wishes and carry them out accordingly.

When deciding who should be your successor trustee keep in mind the type and amount of assets held in your trust, the complexity of the terms of your trust document, and the qualifications of your candidates. Taking over as trustee can require a substantial amount of time and demands a certain level of business and common sense. Make sure you ask the people you are considering as successor trustees whether or not they want the responsibility of managing your trust. Finally, successor trustees should be paid for their time and work. This can be done through your trust document, which should provide for reasonable and fair compensation. Of course, corporate trustees will only accept a position if there’s compensation. If you’re considering a corporate trustee, it’s a good idea to start looking around now. We can help you with the search as part of the estate planning process.

Bottom Line

An estate planning attorney can help you make the important decision of choosing a successor trustee. We are here to answer any questions you may have and provide you the best options for your needs.

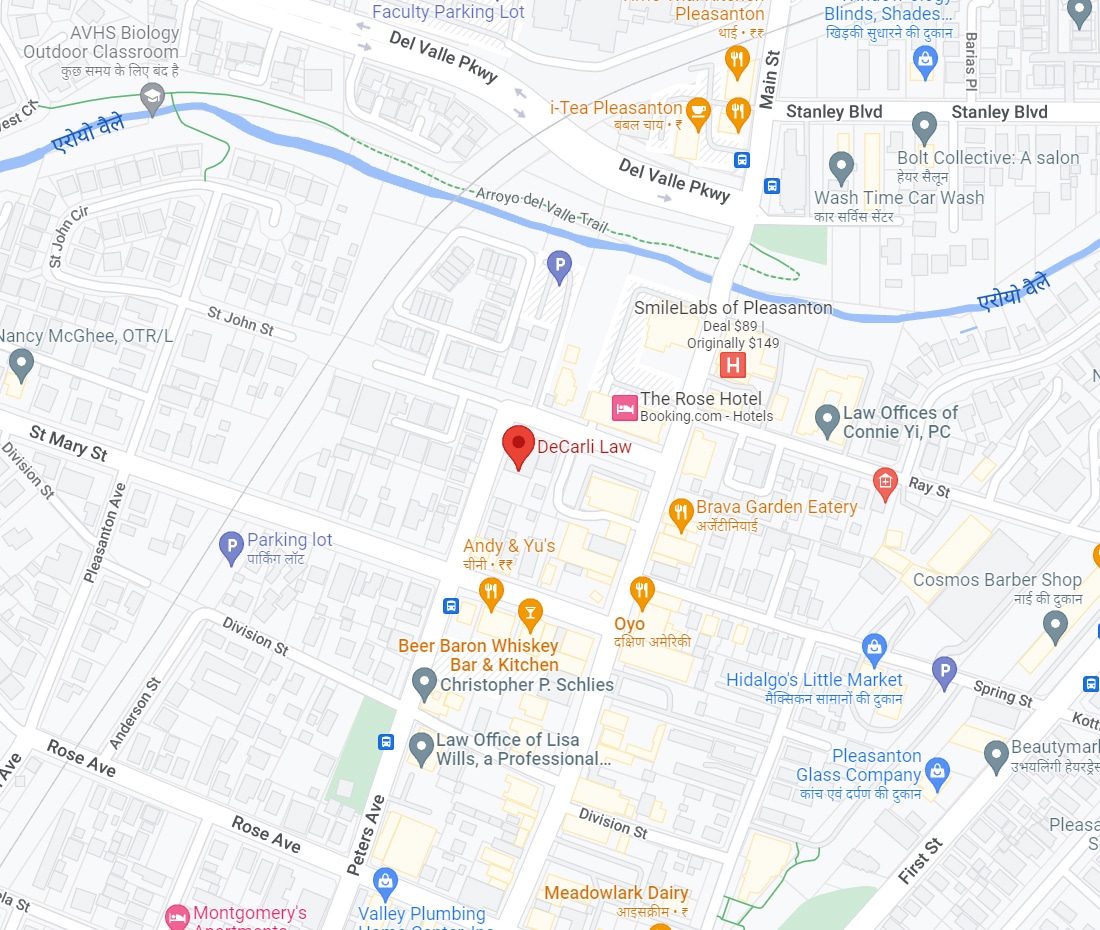

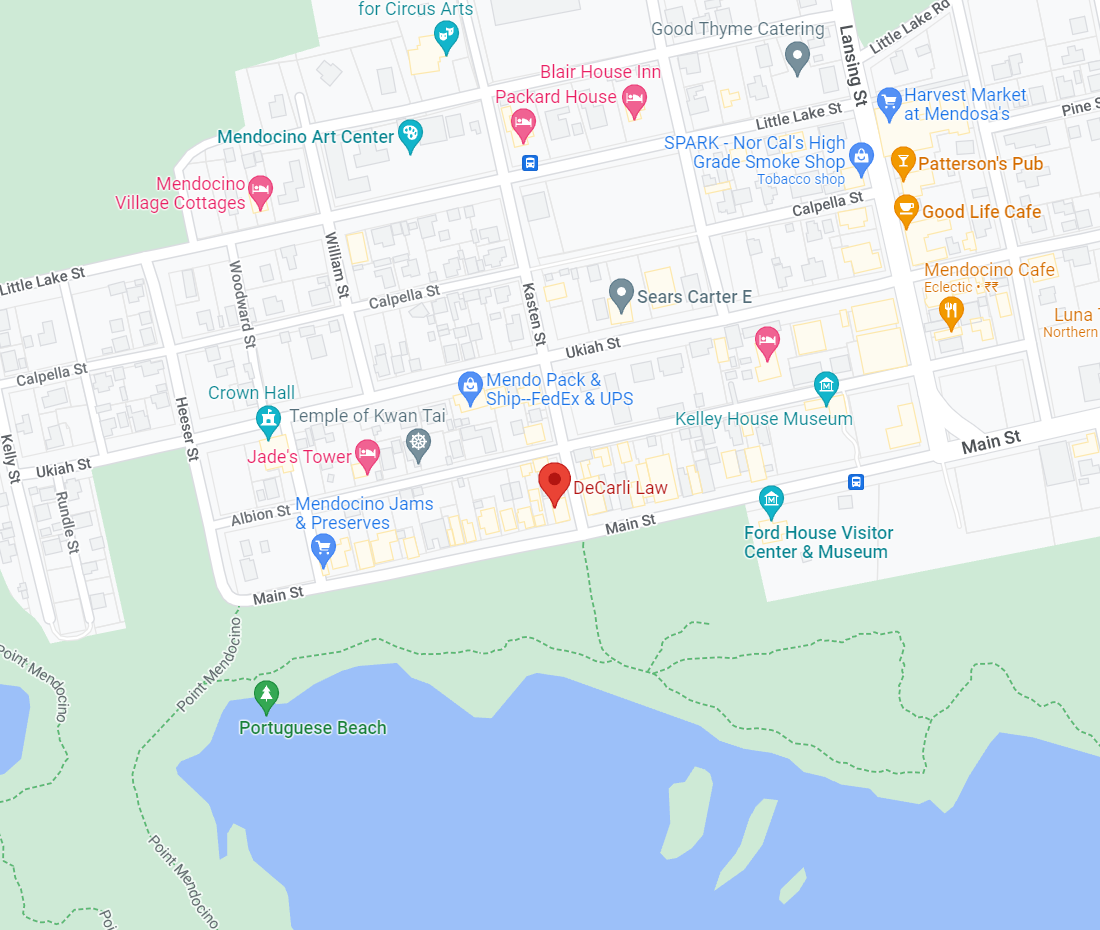

If you would like to learn more about creating an estate plan specific to you and your family call us for a initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment