Trust Administration Attorneys in Mendocino Helping You Manage Your Trustee Responsibilities, Prevent Litigation

In a trust, a private fiduciary arrangement that protects a person’s assets, a trustee holds the critical responsibility of upholding a decedent’s wishes [according to the trust]. Under California law, a trustee must act with reasonable care, skill, and caution when exercising this duty.

Specific commitments of a trustee include following the terms of the trust as written, administering the trust according to the interest of the beneficiaries, avoiding personal opinions and interests, acting reasonably when controlling and preserving the assets, and more.

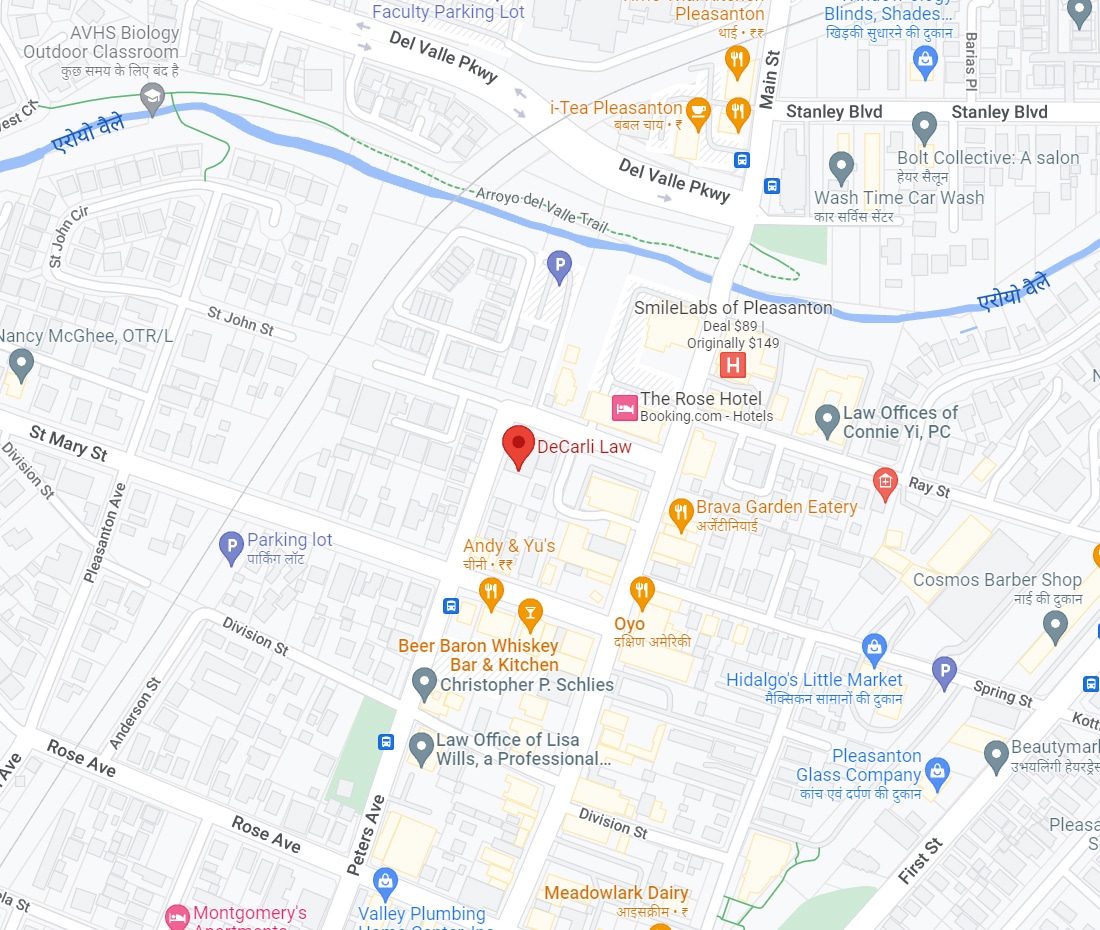

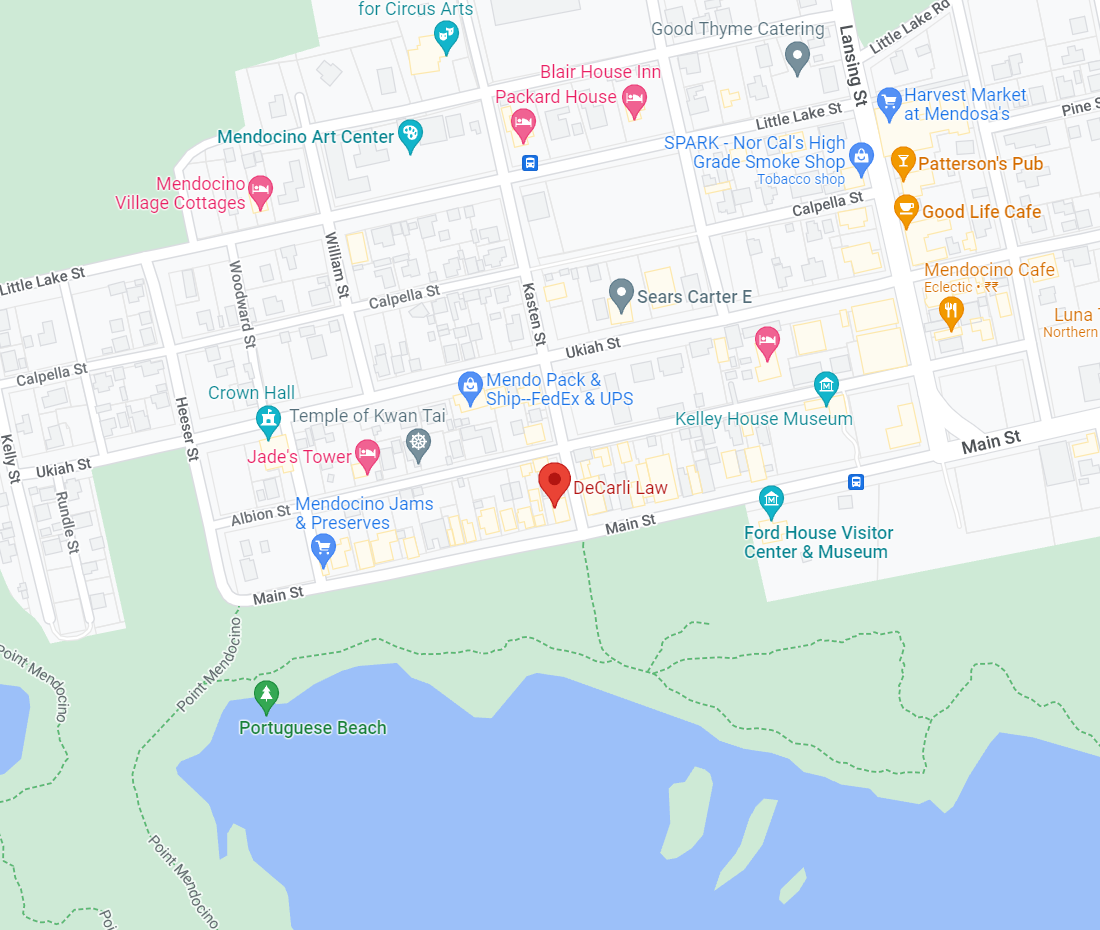

Decarli Law and our trust administration lawyers are experienced in helping trustees properly execute and manage a trust with ongoing legal counsel and representation if duties are called into question.

Our trust administration lawyers can help you avoid litigation by taking the proper steps in this role. Contact us today or book a consultation with one of our attorneys by calling: 707-937-2701.

What is a Trust?

In short, a trust offers legal protection for a person’s assets. It is a fiduciary arrangement that ensures money, assets, healthcare decisions, and other essential end-of-life wishes are acted on and distributed by the trust.

There are different types of trusts, including revocable and irrevocable, intended to protect a person’s assets should they become incapacitated and cannot speak for themselves or in death.

Typically assets in a trust include real estate, tangible property such as jewelry or antiques, brokerage and retirement accounts, cash accounts, business assets, stocks or bonds, and select annuities.

Decarli Law can help you set up a trust, assign a trustee and inventory your assets and final wishes. Contact us to get started.

What is Fiduciary Duty?

In broad terms, a trustee is tasked with fiduciary duties to act in good faith and with integrity and honesty in the interests of the beneficiaries, as outlined in the trust by the decedent. This includes continuous communication with the beneficiaries and complete and total compliance.

Trustees owe the decedent and the beneficiaries a “standard duty of care” and must administer the trust as such; otherwise risk a fiduciary breach of contract and possible legal ramifications.

Fiduciary duties include handling investments, managing unique assets, distributing assets, and administrative tasks such as filing timely and accurate income tax returns and sharing financial statements and tax information with beneficiaries.

What is Considered Poor or Negligent Trust Management?

When agreeing to a trustee role, the trustee decides to always act in the best interest of the decedent and beneficiaries. This includes complying with all fiduciary responsibilities. Any decision while managing a trust that falls outside this scope could put the trustee in a vulnerable legal position.

Examples of poor or negligent trust administration management could include:

- Making reckless decisions with investments or funds

- Stealing assets or funds for personal gain

- Failure to communicate with beneficiaries

- Withholding funds from beneficiaries despite the trust

- Errors or omissions

- Poor or lack of performance

If you are being held accountable for intentional—or unintentional actions—as part of managing a trust, contact Decarli Law to see how we can course correct the situation to prevent a lawsuit. Call us today for a assessment: 707-937-2701.

How Can a Trust Administration Lawyer Help with Litigation?

Death is an emotional time that can cause friction and challenges among family members. When disputes arise, it requires trust litigation to resolve the issue, often between the trustee and beneficiaries.

Sometimes trust litigation results from a trustee not managing the trust properly or for other reasons outside of a trustee’s control, such as a disgruntled, disinherited family member seeking money or assets they believe they are entitled to.

This is the benefit of having a trust, to offer a clear and explicit plan for asset distribution and prevent internal conflict. Our trust administration lawyers can help with trust creation to avoid strife among beneficiaries, represent the trust if a trustee has been fraudulent or has engaged in any wrongdoing or dishonest behavior, and offer assistance as disputes arise.

Contact Decarli Law and schedule a consultation to get legal counsel and trust administration support: at 707-937-2701.