It’s a common misconception that estate planning is only for the wealthy, but in the eyes of the law, an estate is simply the aggregate of property an individual owns, and almost everyone owns something. Property ownership includes individual as well as jointly owned bank accounts, stocks and bonds, retirement accounts, real estate, jewelry, vehicles, your online digital footprint, and even pets. Short of being utterly destitute, you have an estate, and planning for it helps to protect yourself, your family, and your loved ones.

American’s Tend to Not Have Estate Plans

According to Caring.com, fewer Americans than ever are engaging in estate planning. The number of adults who have a will or other types of estate planning documents has fallen nearly 25 percent since 2017. Astonishingly, the demographic of older and middle-aged adults are less likely to have wills and estate plan documents at roughly the same 25 percent rate. Additionally, a growing number of Americans lack the resources and knowledge as to how to get a will. Overall, the prevalence of estate planning documents since 2017 has shown a decrease of almost 25 percent.

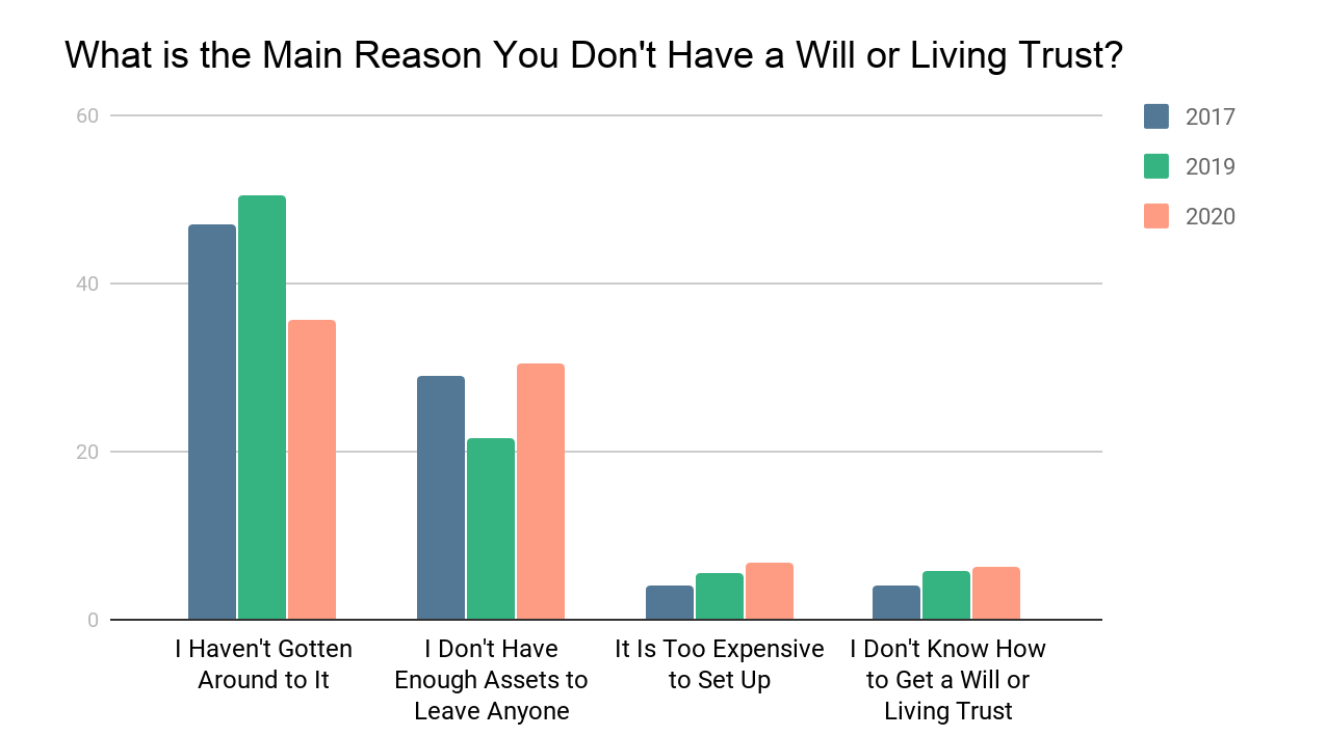

In their annual survey, Caring.com posed the question to its participants as to why they have put off having estate planning documents, and increasingly people cite a lack of education or the perceived cost of estate planning as the most significant reason. Yet 60 percent of the same respondents think planning their estate is either somewhat or very important. Data shows that as a person’s income increases, their likelihood of having estate planning documents like a will, living trust, or advanced health care directives also increases. Still, the number of people with said documents continues to decrease, even in higher-income groups.

In 2020, study participants in the highest income group show a decrease of 26 percent regarding estate planning documents. Even those Americans with the resources to create a will feel it is something they can put off until later in life, which has disastrous consequences for their loved ones in the case of unexpected death.

What is an Estate Plan?

Estate planning is the process of outlining specific instructions as to how you want your money, and other property dispersed upon your death. It includes decisions about your medical care and final arrangements as well. Wills, trusts, and advanced medical directives are the three primary estate planning documents you need to understand and put into place as soon as possible.

What is a Will?

A will instructs how to divide up assets, debt, personal property, and more. A will can cover all of your estate planning needs however, it does come with a few limitations. First, a court process called probate must be started upon death. During this sometimes lengthy process, a judge oversees the transfer of ownership of your property according to your will. Once probate is opened, the will becomes public knowledge, as well as the property that the deceased owns. For those who wish to avoid court or who wish to keep their affairs private, a living trust may be the best option.

What is a Living Trust?

A living trust takes effect at the moment it is enacted while your will only becomes effective upon your death. Planning with a living trust can be more expensive, but it provides the advantage of avoiding probate court and keeps all of your information (and your beneficiaries’ information) private. Further, a living trust can provide for the management of your assets should you become disabled.

What is an Advanced Health Care Directive?

An advanced health care directive, like a living trust, is designed to take effect during your lifetime. This directive stipulates your end-of-life wishes as well as what should happen if you become incapacitated and unable to make decisions about your medical care.

What is a Durable Power of Attorney?

A durable power of attorney covers who will make financial decisions for you if you are unable to. You can specify more than one agent, and you can be very specific about what that agent can do on your behalf, including the management of online accounts.

If you are ready to discuss your planning needs, we would be honored to help. If you have an existing plan, we would be happy to review that plan to make sure it still works for you given your current health and financial circumstances. We look forward to hearing from you!

Call us for a initial consultation at (707) 937-2701, email me at debra@decarlilaw.com or use our online calendar to schedule an appointment at https://calendly.com/decarlilaw/initial-consultation.