Congratulations! Purchasing a new home is both exciting and exhausting. From the parade of professionals involved to the stacks of paperwork at the close, the packing, moving, and unpacking—the process seems endless. In the midst of all this activity, you’re probably not thinking about your estate plan, but now is the time to do just that. Your new home may be your most important investment. It’s important that you understand how to protect it.

I Already Have a Trust—Am I Covered?

If your existing plans include a trust that owns all of your assets, your new home must be re-titled into the name of the trust, or it will not be protected as you intended.

The purchase of a new home is also the ideal time to review your existing plan. While you are titling your new home to your trust, take this opportunity to make sure that the individuals you have appointed as guardian, executor, agent, or trustee are still able to carry out those duties when needed.

New to California?—California Homeowners Need a Trust

If you are moving from another state, welcome! You will definitely want to visit an estate planning attorney. Each state has unique laws regarding trusts and estates, so you need to make sure that any documents you are currently relying on are enforceable in California. Unenforceable or sub-optimal documents can be just as costly to your family as having no estate planning documents at all.

Why California Homeowners Need a Trust

Life in California is wonderful, but like everything else here, the probate process is expensive.

Even if you have a will, a house in California usually must go through probate. A trust avoids probate. California probate fees are set by statute and are set according to the value of the house regardless of the amount still owed on the house. For example, if a home is valued at $500,000, the minimum probate will be at least $13,000. For many families, costs such as these can force a sale of the home.

Also, probate court records are public. During the probate process, all of your assets will be inventoried and available as a public record. With a trust, your personal business remains private.

Can I Create My Own Trust?

DIY online legal services may be tempting, but when it comes to establishing a trust, there is no one-size-fits-all solution to adequately protect your assets. While online services promise a quick result at great savings, beware: they are usually not lawyers, and are not tailoring their product to your unique circumstances.

Setting up your Estate Plan with a knowledgeable, caring attorney is a long-term investment that will save your loved ones many times the amount in the years ahead. Peace of mind for you and security for your family is worth the effort of working with a knowledgeable attorney.

Let Us Help!

Buying a new home is a fresh chapter in your life. Give us a call so we can make sure that you begin this chapter armed with a plan that leaves your family fully protected.

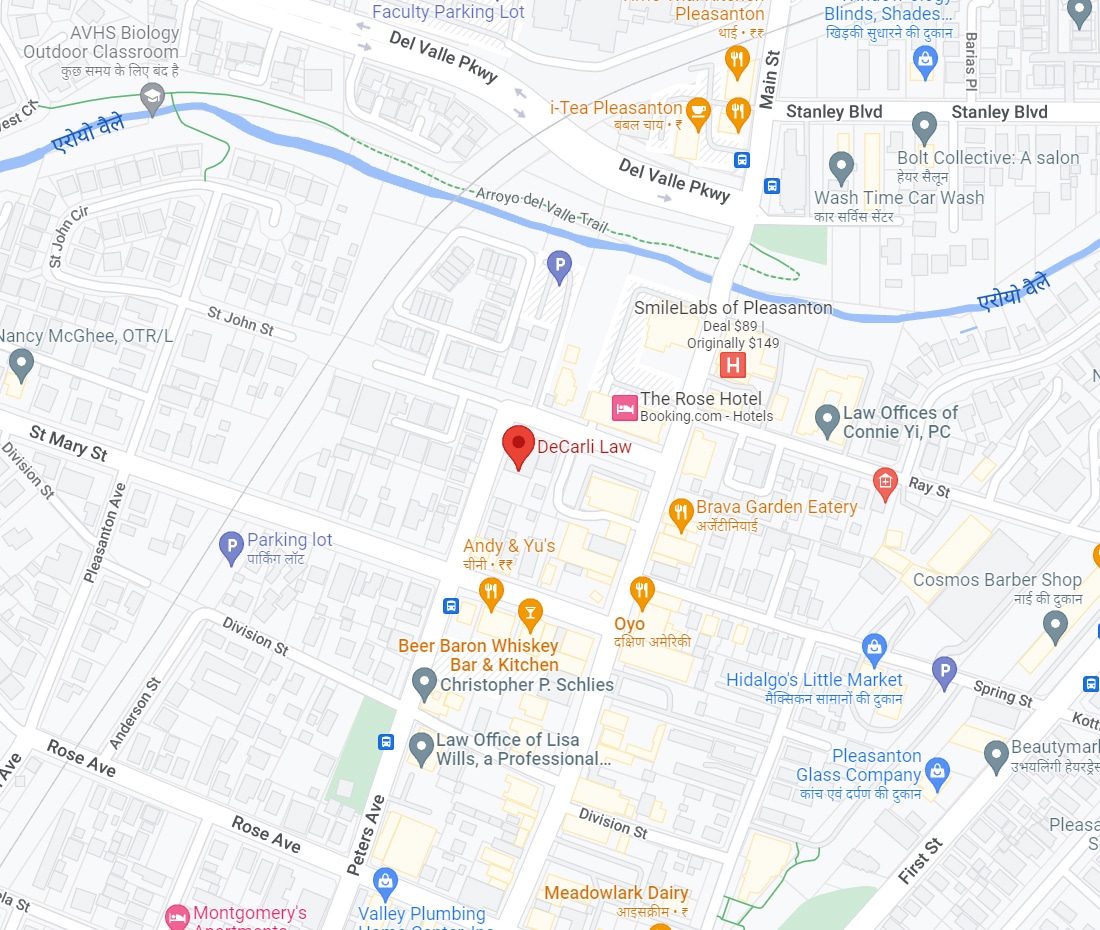

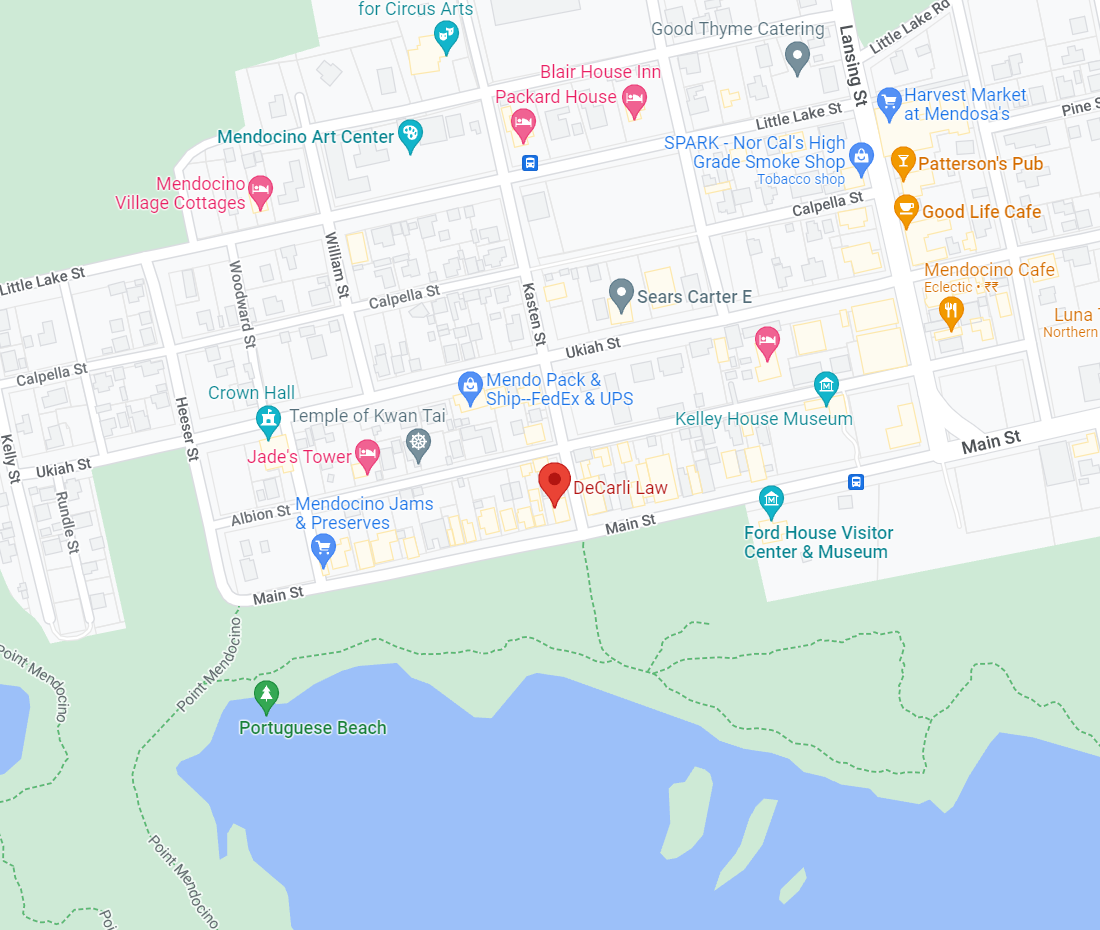

If you would like to learn more about creating an estate plan specific to you and your family call us for a initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment