The last several weeks have seen the introduction of several estate tax proposals at the federal level. The proposals are being positioned as taxes on the ultra-wealthy. However, the reality is if these tax changes are passed they will impact many Californians, including those who own real estate but certainly do not fall into the “ultra-wealthy” category.

We’re keeping a close watch and don’t know what the final legislation will look like, but here is a brief summary of the proposals that will significantly impact estate planning if enacted:

- Elimination in the Step-Up in Basis

- A Reduced Estate Tax Exemption

- A Drastically Reduced Gift Tax Exemption

- Increases in the Estate Tax Rate

The first of these, which has the greatest potential impact on Californians, is contained in the proposed “American Families Plan.” The second, third, and fourth changes are contained in a bill called “For the 99.5% Act,” which was formally proposed by Senator Bernie Sanders and the Biden Administration on March 25, 2021.

Elimination in the Step-Up in Basis to Avoid Tax on Unrealized Capital Gains

Under current tax law, which has been in effect for nearly a century, when a person dies, the person inheriting their property receives a step-up in tax basis. For example, if a home was purchased for $200,000 but is valued at $2,000,000 at death, the person inheriting the property could sell it and not pay capital gains tax.

The proposed American Families Plan would change that. There would no longer be a step up in basis. More significantly, the estate would be responsible for paying the capital gains tax for the increase from the purchase price to the price at death. This is lessened somewhat by a $1 million exemption for individuals, but for a $2 million property in the example above, it would likely mean the property would have to be sold in order to be able to pay the estate taxes.

Reduced Estate Tax Exemption

Under the Sanders/Biden bill, proposed to be effective beginning January 1, 2022, the estate tax exemption amount would be reduced to $3,500,000 from the present level of $11,700,000 per person. Thus, married couples with estates greater than $7,000,000 will now be subject to the federal estate tax.

The gift tax exemption would be limited to $1,000,000 beginning on January 1, 2022.

Under current law, the gift tax exemption is set at $11,700,000, the same as the estate tax exemption. The exemption is reduced when the taxpayer makes gifts to individuals that exceed $15,000 in a given year. If the Sanders/Biden bill is enacted, the exemption will be reduced to $1,000,000.

Significant Increase in Estate Tax Rate

The estate tax rate also will go up on January 1, 2022, from a flat rate of 40% to a progressive rate that will be based upon 45% for the first $6,500,000 of taxable estate, and then 50% on the next $40 million worth of taxable assets, 55% for the next $50 million of taxable assets and 65% on everything over that.

None of these proposals have been enacted yet, and they will likely be changed as they are debated in Congress.

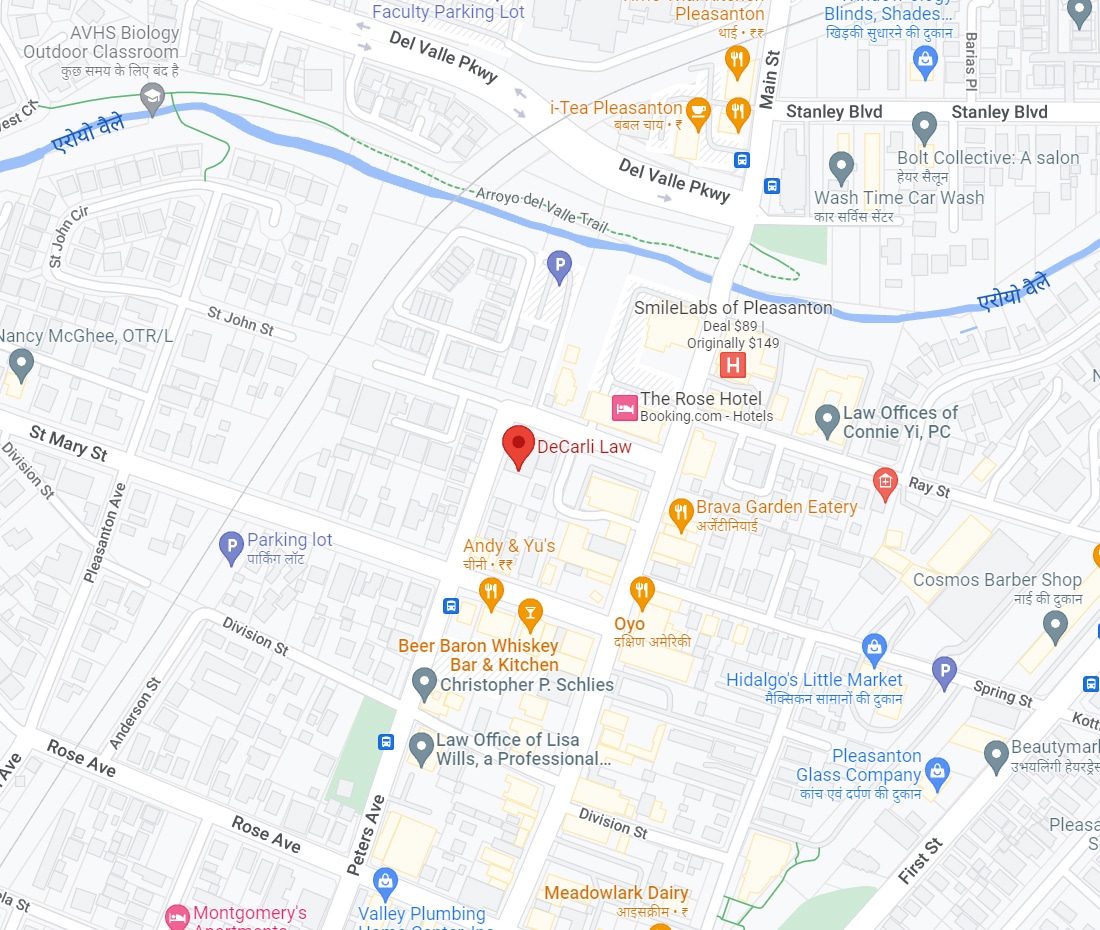

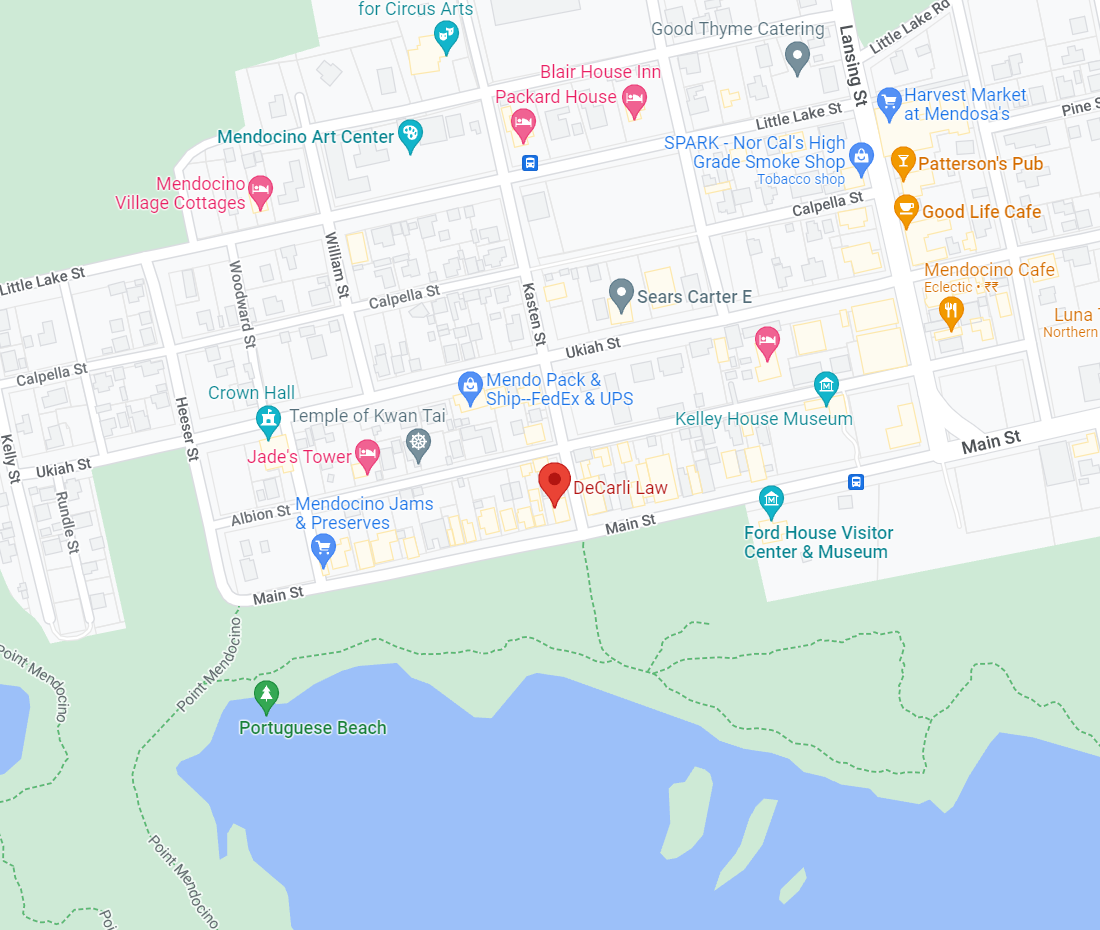

We are closely monitoring these proposals because they will likely affect many of you. Look for updates in the coming months, or call to set up a one-on-one analysis for the impact on your assets and on your family’s future.