Starting a business is a big undertaking with a lot of moving parts. One big consideration should be whether to form an LLC or incorporate. Both forms of ownership can help protect your personal assets from your business liabilities.

For most new businesses, when we talk about incorporating, we talk about “S corps” rather than “C corps”, so for simplicity, that is what I will address here.

There are similarities and differences between LLCs and S corps that business owners need to understand before deciding to LLC or incorporate:

Similarities

- Both an LLC and a corporation are created by filing the necessary paperwork with the state. State law does not recognize LLCs and corporations until the filing has been made.

- Both an LLC and a corporation provide owners with limited liability, meaning the owner’s personal assets are protected from any business creditors’ claims.

- Both an LLC and a corporation can be taxed as a “pass-through” entity. This means the LLC or corporation do not pay income taxes, but the net profits flow through to the owners as their taxable income.

Differences

S Corp

- Owners of S corps may be able to reduce or eliminate the need to pay self-employment tax. An S corp owner can be treated as an employee and paid a reasonable salary.

- S corps are subject to strict ownership rules: S corps can have no more than 100 shareholders, may not have non-U.S. citizens as shareholders.

- S corps are subject to mandatory requirements as to how the entity is managed. For example, S corps are often required to adopt bylaws, issue stock, hold regular meetings, and maintain meeting minutes within its corporate records.

- S corp owners must share profits equally based on their percentage of ownership.

- S corps generally provide enhanced asset protection, as the structure creates more separation between the owners and the company.

LLC

- LLC owners generally pay personal income tax based upon the business’s net profits.

- LLCs can have an unlimited number and type of owners.

- LLCs are not subject to these types of requirements.

- LLC owners have wide latitude to split profits and losses in any manner that is agreed upon.

- LLCs are generally cheaper to form and operate.

What is best for your business?

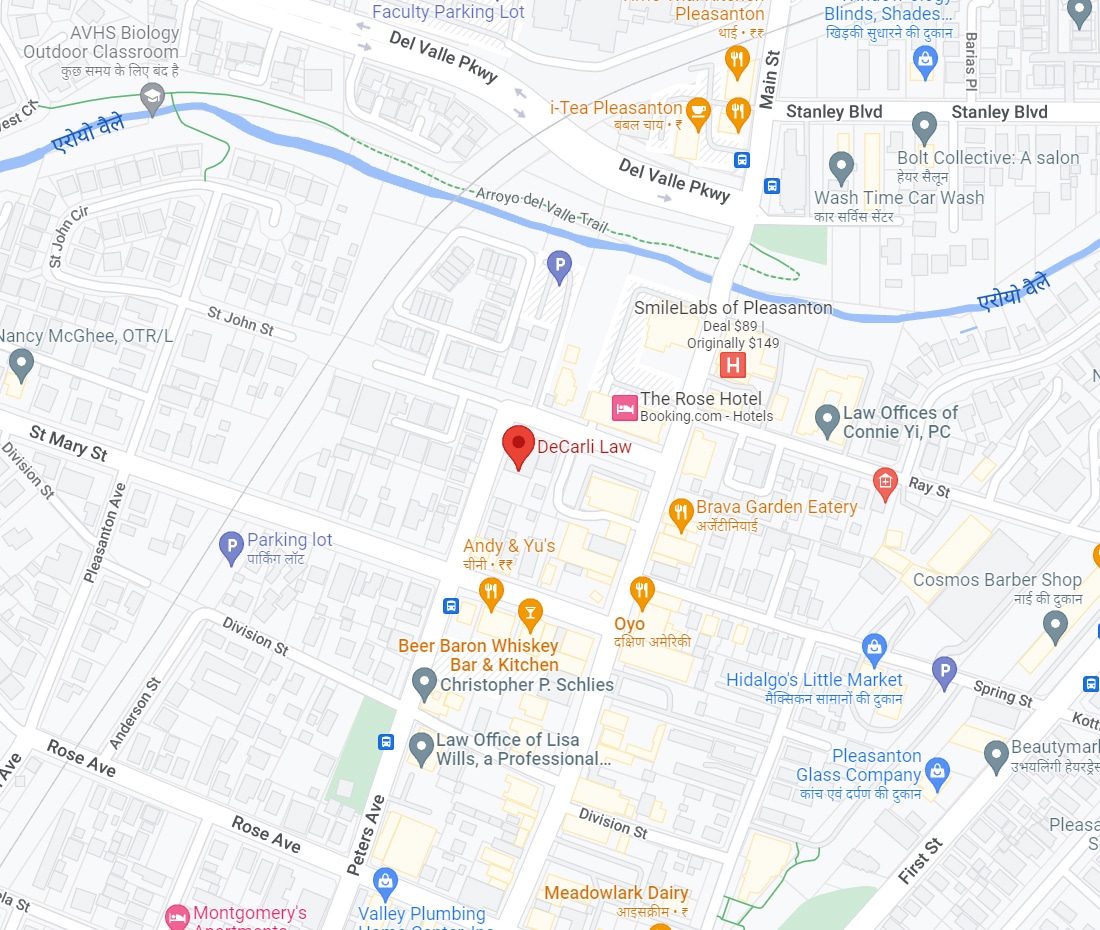

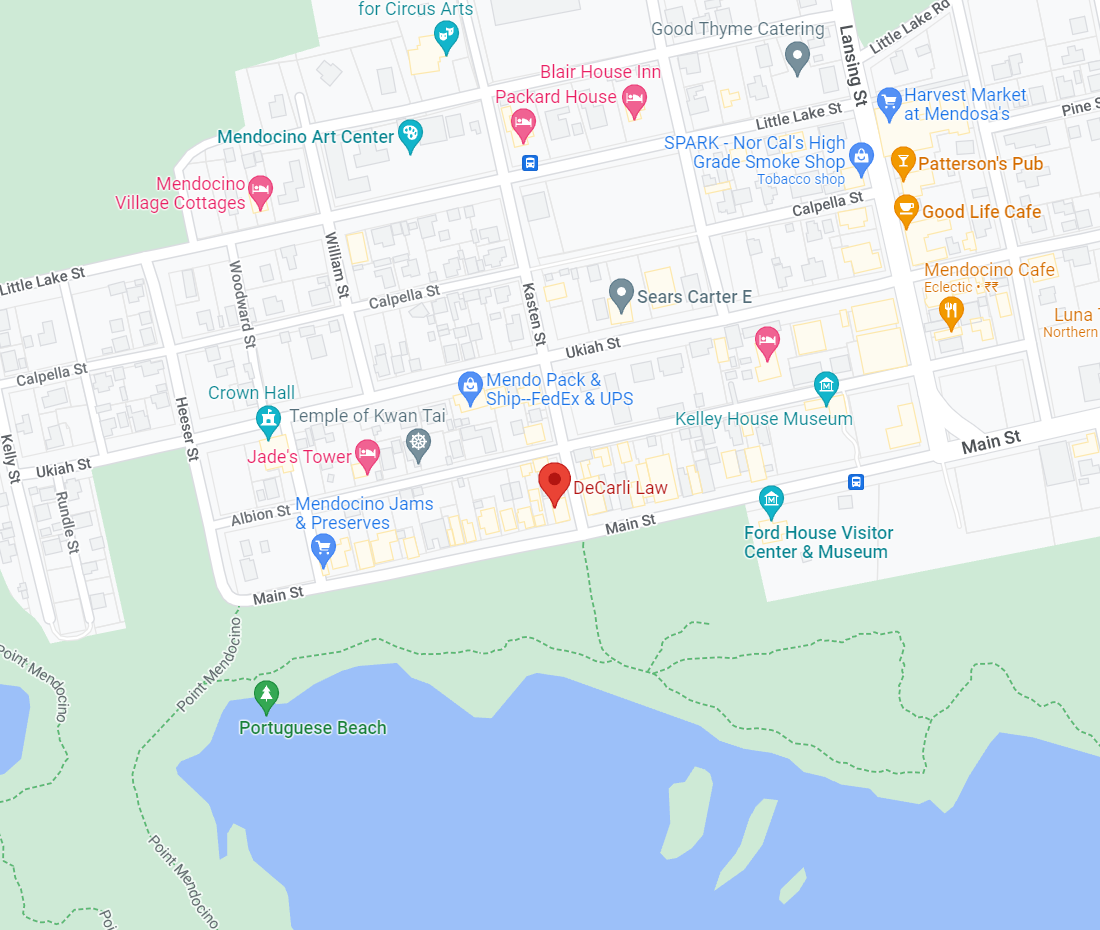

Each business has its own unique circumstances to consider. Don’t go it alone. We are here to discuss how to properly structure, form, and protect your business, whether you choose to LLC or incorporate. https://decarlilaw.com/practice-areas/business-law/

Please give us a call or book online to schedule a initial consultation today.

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment