Whether or not you currently have estate planning documents, an estate plan checkup should be on your to-do list.

Estate Plans Are NOT Just for Wealthy People

A common misconception is that estate planning is only necessary for wealthy people. But this simply isn’t true:

- In California, probate fees can be substantial. A Living Trust avoids probate fees and keeps your assets private.

- Anyone in California who owns a home–even if you owe money on a mortgage–should have a Living Trust.

- Likewise, a Trust puts a plan in place for what will happen to bank accounts, retirement accounts, or a family needs if you become incapacitated or die.

- In addition to a Living Trust, current Advance Health Care Directives and Powers of Attorney are essential.

Don’t Have an Estate Plan?

Here’s why you should have an estate plan:

- If you become incapacitated, you and your property may end up in a court-supervised guardianship.

- After you die, your property and your loved ones will end up in a time-consuming and expensive probate proceedings.

- Worse yet, if you don’t take the time to have any estate planning done, then the state will essentially write one for you–and charge a hefty fee for doing so! It most likely won’t divvy up your property the way you would have and certainly will not protect your heirs the way you would.

How Old Is Your Estate Plan?

Do you already have an estate plan?

If you do, then please pull your documents out of the drawer, dust them off, and look at the date you signed them.

Were your documents signed in the 80s or 90s, or the early 2000s? If so, your documents are likely terribly out of date. You need an update as soon as possible. Federal estate taxes, gift taxes, and generation-skipping transfer taxes went through major changes during these years.

And, it’s not just tax laws that are changing–regularly updated Advance Health Care Directives and Powers of Attorney are essential to taking care of yourself and your family if you become incapacitated or die.

Life Changes!

Regardless of what year you signed your estate planning documents, think about all of the changes in your life since you signed them. Did you get married or divorced, have a child or two or a grandchild or two, or move to a new state? Did you sell your business, retire, have a significant change in assets, or win the lottery? Any major changes in your family or financial situation will certainly have an effect on your estate plan.

Estate Planning Is Not a One and Done Deal

Estate planning is not a static event that you can do once and then forget about it. It is a continuing process. Life is a moving target that is full of constant change. Your estate plan needs to change as your life changes.

We are here to help figure out how to get started, and how to keep up to date.

An estate plan customized to suit your family’s needs costs a fraction of what probate will cost. It allows you to control what becomes of your property. Plus, the paperwork after your death will be minimal, there will be no need to file anything with the probate court, and your personal business and finances remain private.

We’re Here to Help

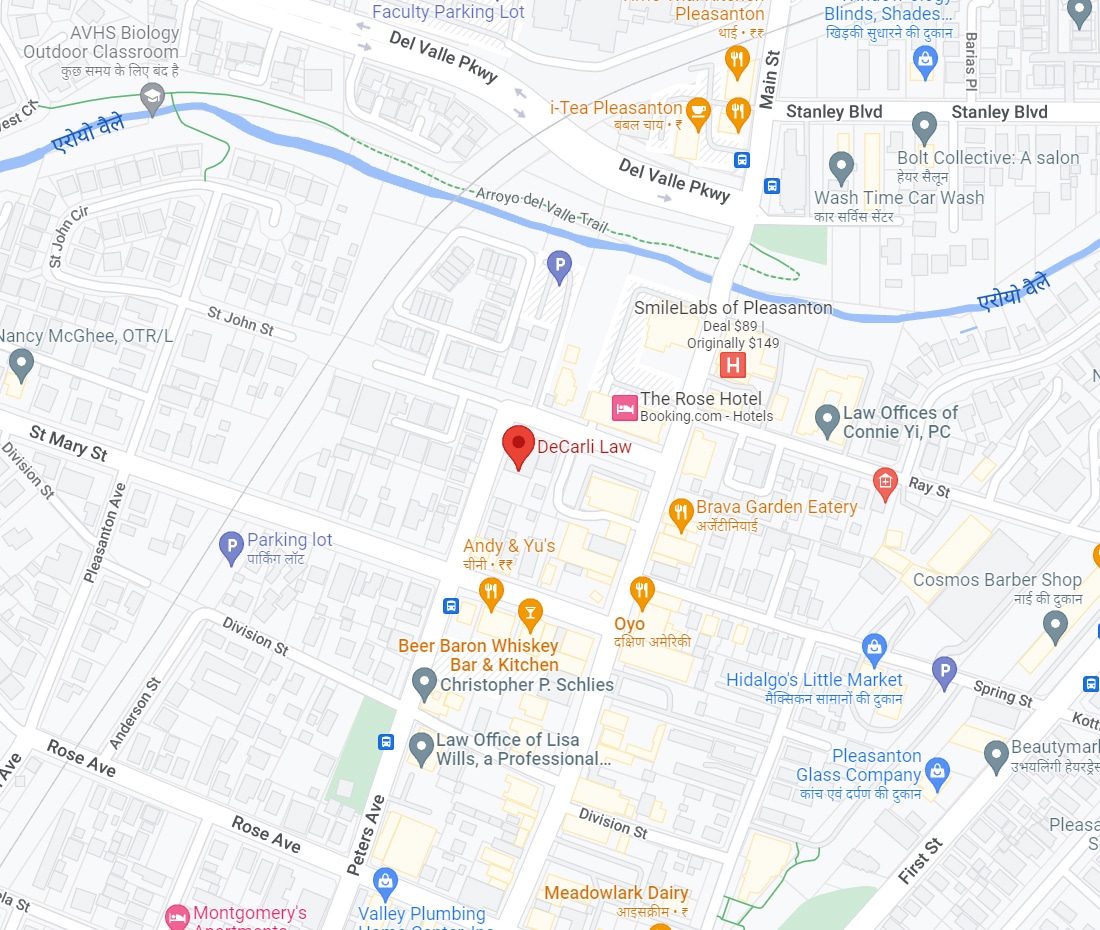

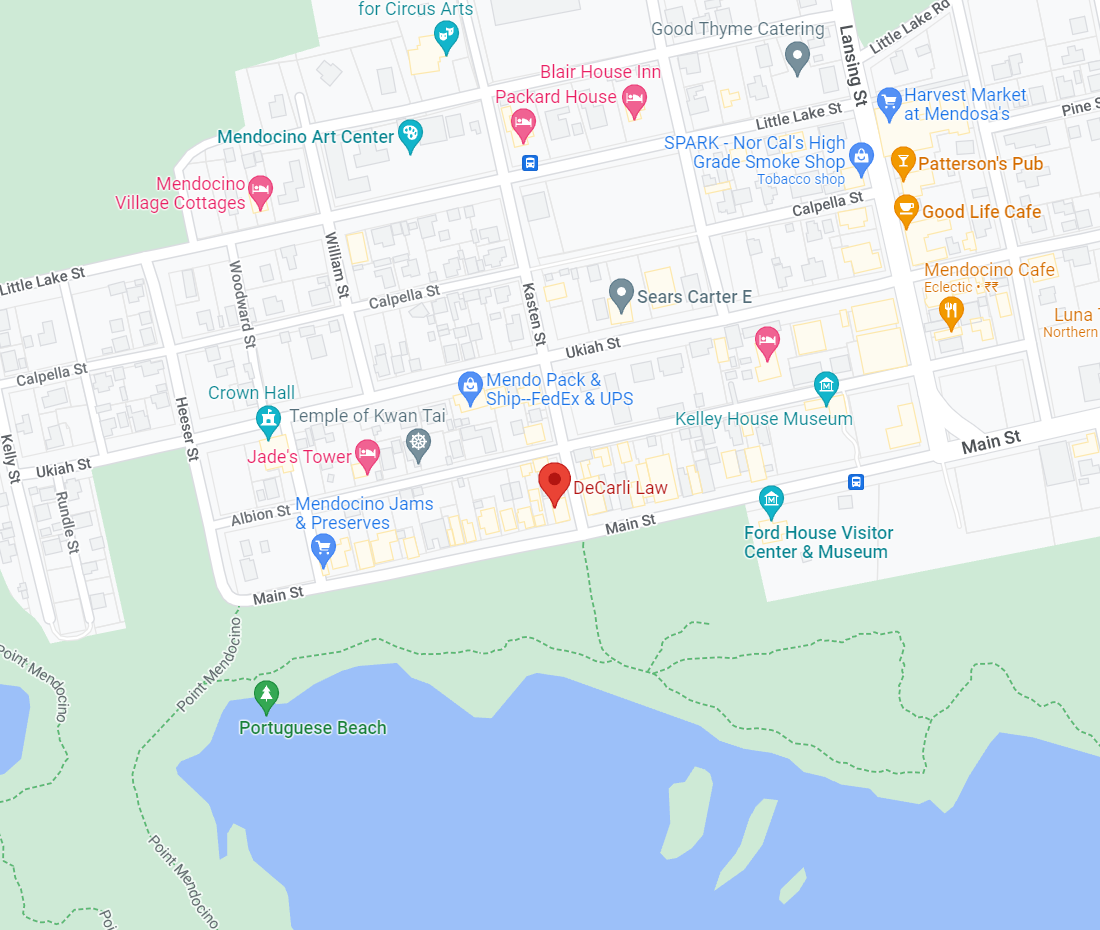

If you would like to learn more about creating an estate plan specific to you and your family call us for a initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment