You bought plane tickets and planned your itinerary, stocked up on sunscreen and a beach novel. But have you ensured that your estate plan is up to date?

We do a lot of “last-minute” estate plans for people who planning a trip (or who are having surgery). Optimally, we will have a complete plan signed and ready before you leave. At a minimum, we can get basic documents in place.

A lot of people think they don’t have time, or they are intimidated at the thought of starting the process. It is my job to make the process as easy as possible for you.

Estate Plan: The Process

1. Get to know one another

I start with a get to know you meeting. It’s my job to listen, and to ask the right questions to be able to design the best plan to suit you, your family, and your circumstances.

2. Draft documents reflecting your family’s wishes

After getting to know you and taking down some basic information, I’ll put together draft documents. This usually takes me a week or so, BUT for people who are having surgery, are very ill, or who are planning to leave the country soon, I can translate your wishes into draft documents on a short turnaround without sacrificing quality or attention to detail.

3. Review for details

We will review the drafts together, and tweak any personal and family details that need to be addressed.

4. Good to go

Then we will sign and notarize everything, scan the documents so you have digital documents, and organize your originals in a binder. And — you’re good to go!

Estate Plan: Getting Started

Here are some estate plan basics we will start with:

1. Protect your children

If they are still young, let’s designate a guardian to care for your minor child or children in the event you are unable to. If the kids are staying with family or friends for part of the summer without you, let’s make sure that the person they are with has the right paperwork to take them to the emergency room or dentist, just in case.

2. Your will

With a few basic questions, we can help you create a will if you do not already have one. We can also update an existing will.

3. Consider a trust

Trusts are not just for the super-rich. In California, if you own a home, a trust is the best way to control your assets while you are alive, if you become incapacitated, or after your death.

4. Protect your business

If you own a business, have you named a proxy to manage your interest if you cannot? Do you have a business succession plan? If you co-own a business, have you drawn up a buyout agreement?

Update, Update, Update

Have you already created an estate plan? That’s great! It’s still important to verify that all provisions made in the estate plan are exactly as you want them.

Confirm before leaving town:

1. Are your assets accurately inventoried?

Have you left out any important assets or neglected to report changes?

2. Are your beneficiary designations current and accurate?

Are your assets going where you would like them to? New family members?

3. When was the last time you reviewed your selection of fiduciaries?

Review your Personal Representative, Successor Trustee, Power of Attorney, and Health Care Agent regularly to ensure that the folks you originally chose are still the best people to act on your behalf if you are incapacitated or die.

~Evening and Home Visit Appointments Available~

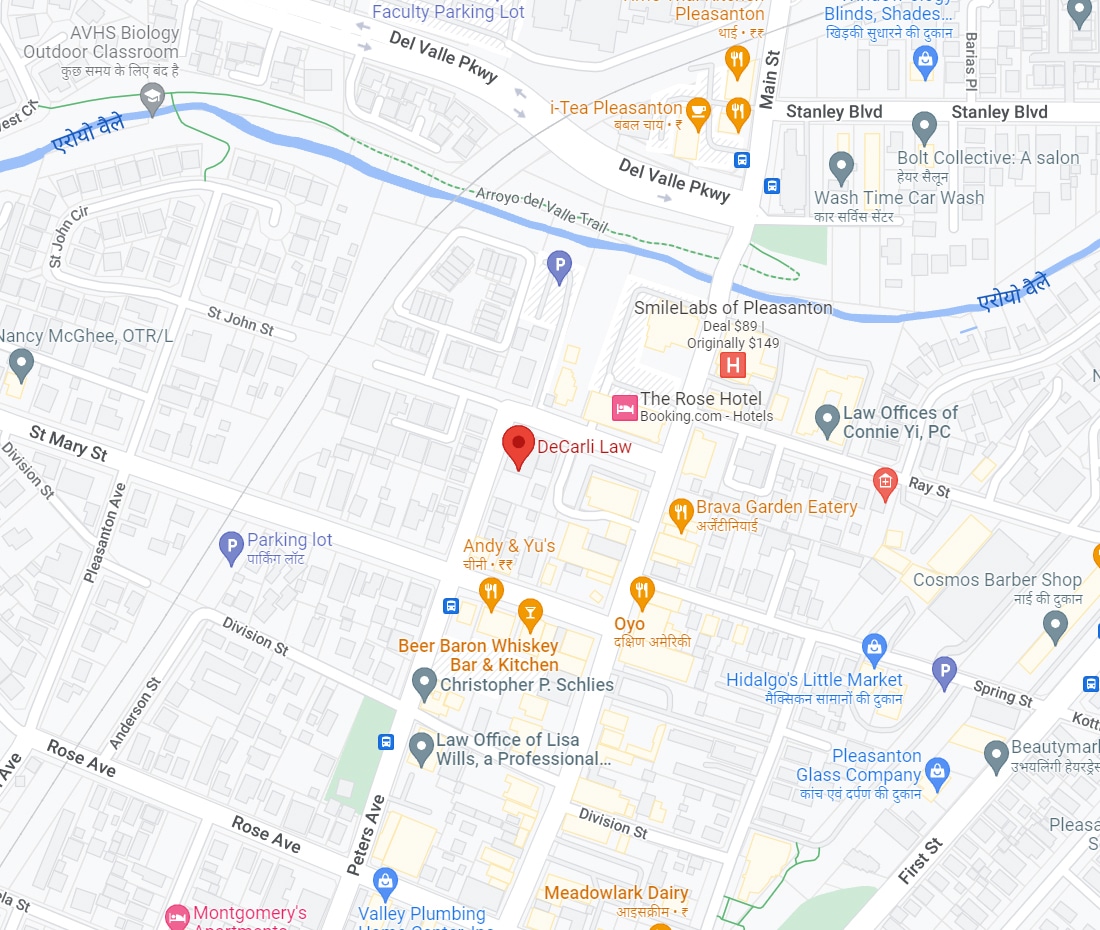

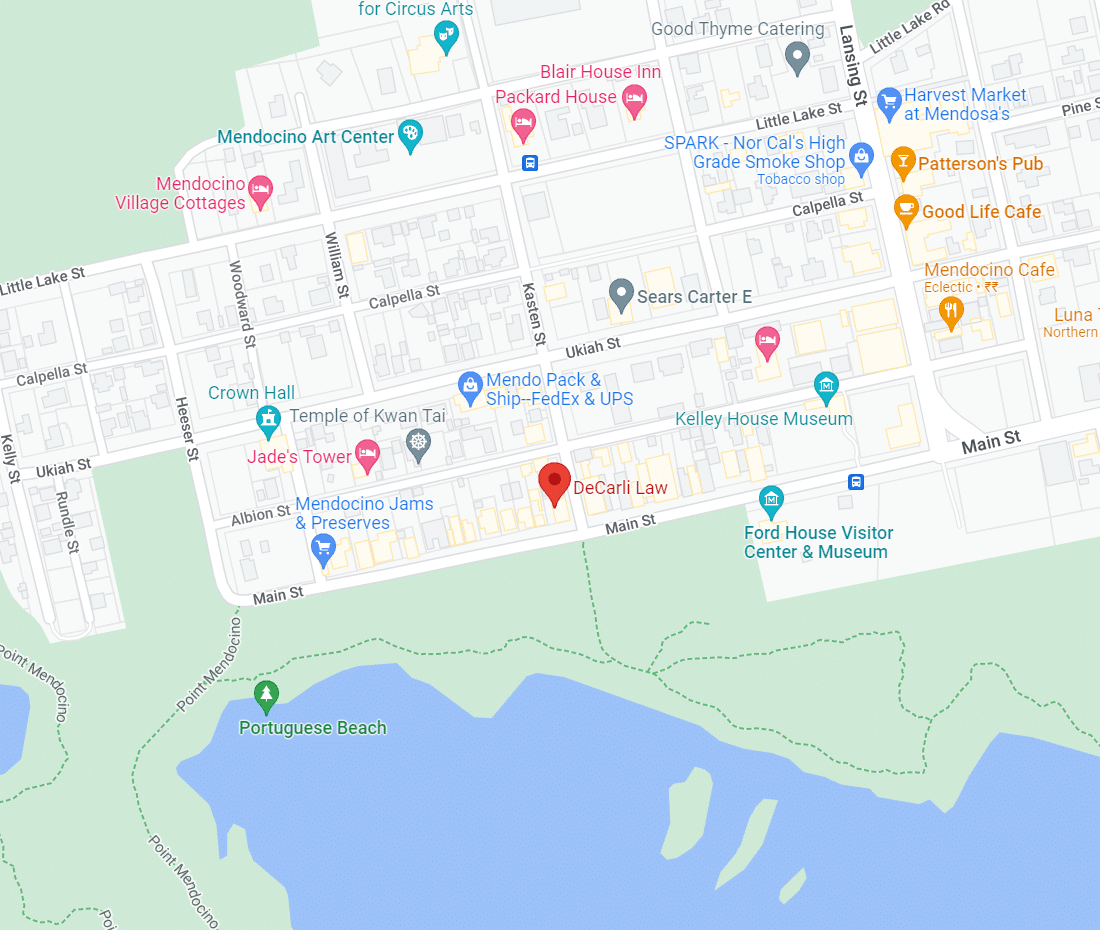

If you would like to learn more about creating an estate plan specific to you and your family call us for a free initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment