When we think of preparing for the future, having a will is often the first thing that comes to mind. But ‘Estate Planning’ is so much more than simply having will. Creating a revocable trust gives you flexibility over your assets while you’re alive and also clearly states your intentions should you become incapacitated and unable to manage your affairs, as well as after your death.

A Revocable Trust Avoids Probate

Having a will alone does not avoid probate–a will must go through probate court.

Probate is the legal process by which a court decides the rightful heirs and distribution of assets of the deceased. The probate process can easily take months to years to resolve. Plus, probate proceedings are expensive, time-consuming, and open to public scrutiny. Avoiding this lengthy and expensive process with a trust is a crucial step toward protecting your assets and privacy.

A Revocable Trust Puts You In Control

Revocable Trusts are not simply just about avoiding probate. Creating a revocable trust can give you privacy, provide ongoing financial support for loved ones, and protect you and your property if you are unable to manage your own assets. The creation of a trust puts you in control when it comes to your assets and your wishes. Without a trust, you may be leaving critical life decisions to someone who has no interest in your life or the well-being of those you love.

Incomplete beneficiary designations forfeit your control.

Even if some parts of your estate, or jointly owned accounts or property pass directly to your spouse or children through survivorship benefits, these are incomplete solutions. You forfeit control over your assets and how your affairs are managed. In California, probate costs associated with real estate are based on the assessed value of the property–regardless of mortgages or monies owed. In practice, this means that your heirs could well lose any property you leave them in court costs alone.

A Revocable Trust Manages Assets

Another good reason to create a revocable trust is to provide ongoing financial support for a minor child or another loved one who cannot, or may not ever, be able to manage these assets on their own. Through a revocable trust, you can designate someone to manage and distribute assets and care for your heirs under the terms you provide.

Passing on an inheritance to an heir directly and all at once may have unanticipated effects and consequences, such as disqualifying them from receiving some form of government benefits or encouraging irresponsible or even dangerous behaviors. A trust offers you the ability to attach conditions to a distribution that must be met for your heir to receive the benefit of the gift. Importantly, if you do ever become incapacitated, your successor trustee—the person you name in your trust to take over after you pass away or become incapacitated – can step in and manage the trust’s assets. This layer of protection can be essential in an emergency or in the event you succumb to a serious, chronic illness. Unlike a will, a trust can protect against court interference or control while you are alive and after your death.

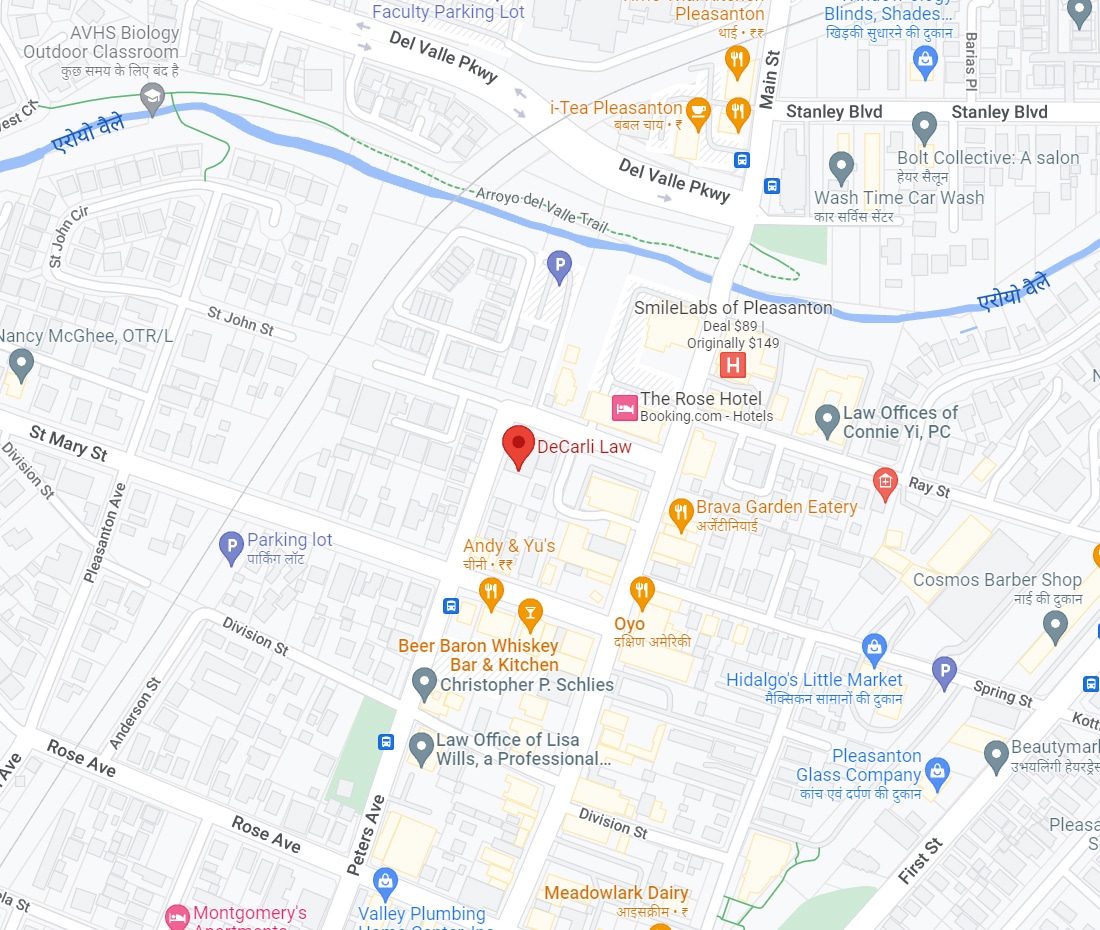

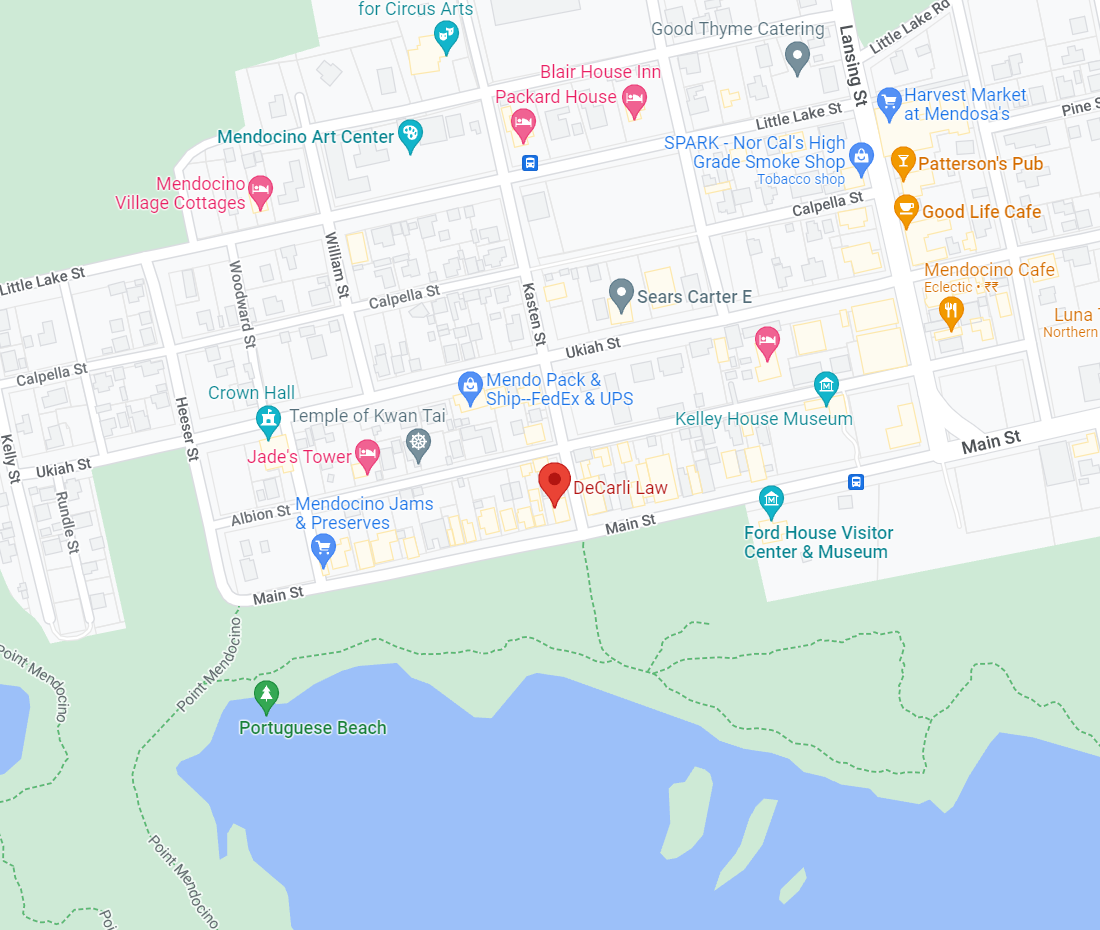

If you would like to learn more about creating an estate plan specific to you and your family call us for a initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment